- Home

- About Us

- Services

- Accounts Payable Management

- Annual Tax Preparation

- Audit Preparation

- Account Reconciliation

- Accounts Receivable Management

- Bookkeeping

- Bookkeeping Clean-Up

- 1099/1096 Preparation and Filing

- Sales and Use Tax

- Financial Planning

- Financial Statements

- 401K Management

- Benefits Management

- Cash Forecasting

- KPI Tracking

- Payroll Services

- Tax Consulting

- On-Boarding / Off-Boarding Services

- Reviews

- Contact Us

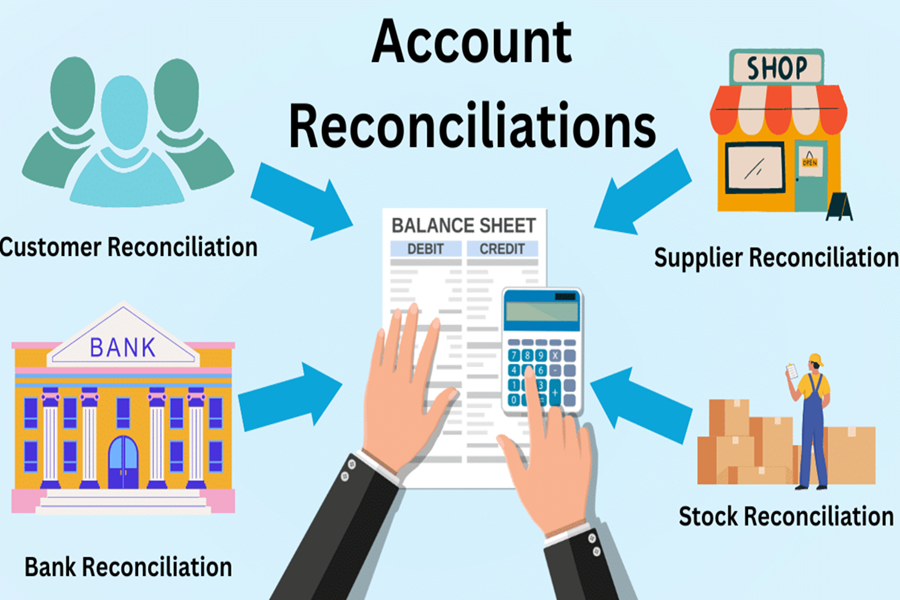

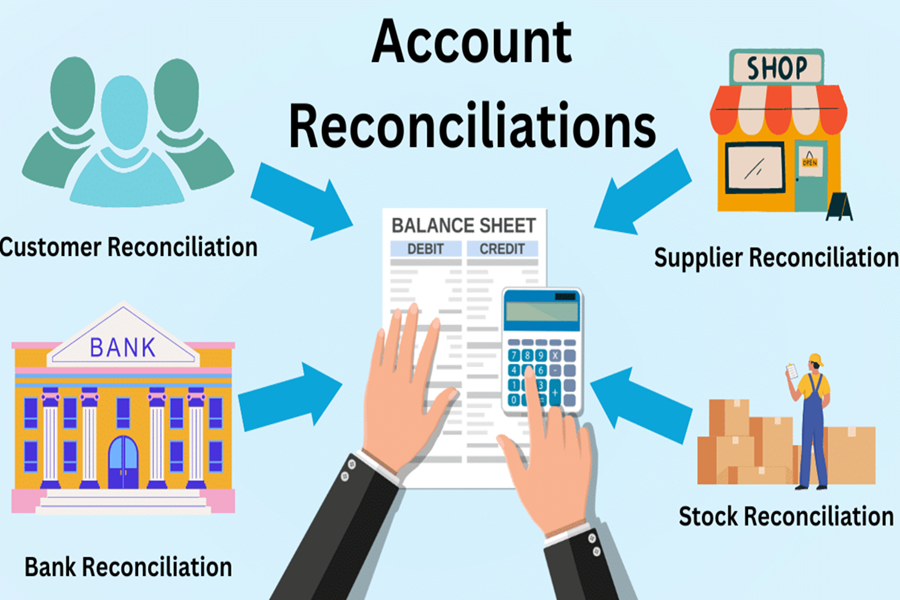

Account Reconciliation

- HOME

- Account Reconciliation

Account Reconciliation Services in Point Pleasant, NJ

Keeping your business’s financial records accurate is essential. JLD Accounts offers professional account reconciliation services for businesses in Point Pleasant, NJ and Ocean County. Our process ensures your bank, credit card, and financial statements are aligned with your records, reducing errors and giving you clear insights into your finances.

Account Reconciliation Services in Point Pleasant, NJ

Keeping your business’s financial records accurate is essential. JLD Accounts offers professional account reconciliation services for businesses in Point Pleasant, NJ and Ocean County. Our process ensures your bank, credit card, and financial statements are aligned with your records, reducing errors and giving you clear insights into your finances.

Why Account Reconciliation Matters

Financial Accuracy and Control

Errors in financial records can lead to costly issues and misinformed decisions. Our account reconciliation ensures every transaction is accurately recorded.

Reducing Errors and Preventing Fraud

With consistent reconciliation, we catch potential errors and identify unauthorized transactions, giving you financial control.

Building a Reliable Financial Foundation

Accurate records support better decision-making, giving you a solid foundation for financial planning.

Preparing for Tax Season and Audits

Accurate and organized records are key during tax season and audits. Our services ensure your accounts are compliant and easy to review when needed.

Our Account Reconciliation Process

Reviewing Financial Statements

We start by gathering your bank and credit card statements and internal records, reviewing them for completeness and accuracy.

Identifying and Correcting Discrepancies

Our team carefully examines transactions, correcting any inconsistencies such as missing entries or duplicates.

Reconciling Each Account

We verify each transaction, ensuring that your bank, credit card, and financial records match precisely.

Investigating Unusual Entries

Any unusual or unclear entries are flagged and investigated to ensure every detail aligns with your business’s actual activities

Providing Transparent Reporting

After reconciliation, we provide a report detailing each transaction and any adjustments made, giving you a clear financial overview.

Benefits of Professional Account Reconciliation

Improved Cash Flow Management

With updated reconciliations, you gain accurate cash flow insights, allowing for better expense planning and budgeting.

Avoiding Cash Flow Shortfalls

Knowing your exact cash position helps you avoid financial surprises and ensures you’re prepared for future expenses.

Reduced Compliance Risks

Errors in your financial records can lead to compliance issues. Our reconciliation services help ensure accurate, compliant records.

Confidence in Audits and Tax Reporting

Accurate reconciliations reduce risks of penalties or issues with regulatory bodies, giving you peace of mind.

Enhanced Financial Insights

Reconciled records allow for transparent reporting, making it easier to share financial data with stakeholders and make informed business decisions

Why Choose JLD Accounts for Account Reconciliation?

Experienced and Meticulous Team

Our team’s expertise ensures your accounts are accurate and secure, with each detail reviewed to uphold high standards.

Customized Solutions for Your Business

We tailor our reconciliation services to your needs, whether you need monthly, quarterly, or yearly support.

Transparent and Trustworthy Service

We value transparency, keeping you informed with regular updates and detailed reporting, so you always know where your finances stand.

Get Accurate Account Reconciliation with JLD Accounts

Trust JLD Accounts for precise, reliable reconciliation services. We’ll keep your records aligned, accurate, and ready for audits or tax season. With our expertise, you gain financial clarity and control, allowing you to focus on growing your business.

Contact Us Today

Need expert reconciliation support? Contact JLD Accounts to learn about our account reconciliation services in Point Pleasant, NJ and Ocean County. Let us help you achieve financial accuracy and peace of mind.

Frequently Asked Questions

What is account reconciliation?

Account reconciliation involves comparing your internal financial records with external statements (such as bank or credit card statements) to ensure they match, and identifying any discrepancies.

How often should account reconciliation be done?

Account reconciliation should be done at least monthly to catch any discrepancies early and ensure your financial records are accurate and up to date.

What happens if there are discrepancies during reconciliation?

If discrepancies are found, we investigate and resolve the differences, which may include correcting errors in transactions, updating records, or contacting your financial institution.

Can you reconcile multiple accounts at once?

Yes, we can reconcile multiple accounts, including bank accounts, credit cards, loans, and other financial records, ensuring everything aligns across the board.

Why is account reconciliation important for tax season?

Reconciliation ensures your financial statements are accurate, which is crucial for tax preparation. Clean, reconciled books prevent errors and reduce the risk of audits.

How long does account reconciliation take?

The time required depends on the volume of transactions and the number of accounts. Most reconciliations can be completed within a few business days.